From Trainwreck to Turnaround: My Bet on Abercrombie & Fitch

Fran Horowitz and the New Abercrombie

Introduction

Abercrombie & Fitch is an omnichannel retailer that mainly sells apparel products for men, women, and kids under two major brands: Abercrombie & Fitch and Hollister. The firm struggled during the period after the GFC and through 2017. It went through a leadership change in 2014 and transformed the brand image from “exclusive” to “inclusive”. This shift was led by the newly appointed CEO Fran Horowitz and resulted in the resurrection of the declining Abercrombie & Fitch brand.

While COVID-19 posed challenges, the impact was relatively mild. Disciplined capital allocation and brand repositioning under Horowitz gradually improved profitability.

Recent geopolitical developments, particularly around tariffs, are expected to impact the business by increasing the cost of goods considering that the firm currently sources slightly over a third of the inventory from Vietnam and thus, placing pressure on margins. However, the firm’s balance sheet remains healthy and debt-free.

Despite healthy balance sheet and strong cash flow, the stock has declined significantly due to the broader economic backdrop. Softness in consumer spending and consumers’ general fear of tariffs, inflation, and economic recession are the main reasons. Once these headwinds normalize in the consumers’ minds – becoming part of day-to-day life – the firm is expected to return to strong growth, as will the stock.

This investment analysis follows a framework inspired by Todd Combs’ writing in the 7th Edition of Security Analysis and evaluated the business through three essential lenses: 1) Business Quality 2) Management Quality 3) Valuation.

Business Quality: Is it a good business?

The nature of the apparel business offers little inherent moat. In fact, it is part of the consumer discretionary industry. It is in an hyper-competitive landscape vulnerable to fast-changing fashion trends and fickle consumer preferences. An investor cannot predict a fashion trend, so the author shall not attempt to do so. However, consumer demand may be a bit less difficult to predict.

That said, the caveat to this “less difficultness” is that it involves judgements about macroeconomic trends, considering the geopolitical and economic backdrop. Hence – ironically – it does not really make it less difficult.

However, the macroeconomic trends are transitory, and this transience actually works in the investor’s favor. Once the unstable backdrop normalizes, the business will likely see a favorable boost to its sales and profitability. But because when and how such a settlement will occur is a billion-dollar question the author is not trying to solve, the only prediction that can be made is that conditions will eventually improve. Nothing more.

This leaves the author to look at the firm at a company level – neither the industry level nor the macro level.

Brands

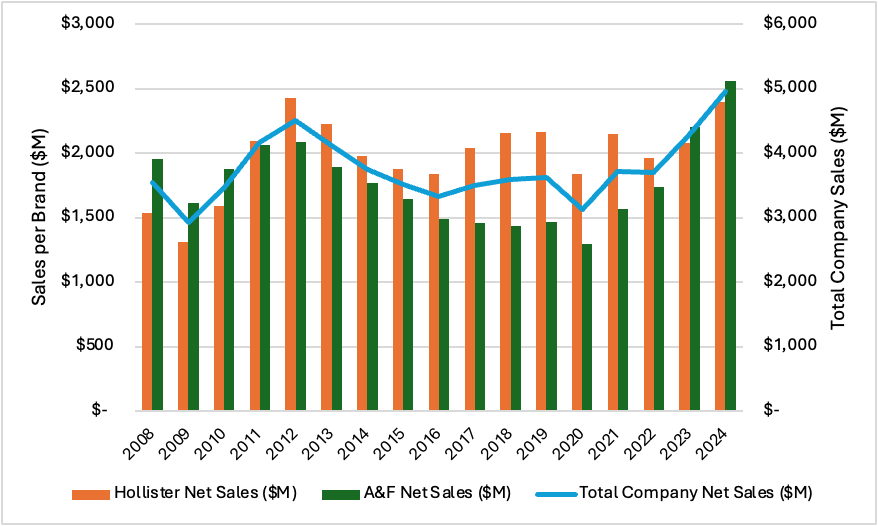

The firm has two brand families. The Abercrombie & Fitch (A&F) brand includes Abercrombie & Fitch and abercrombie kids. Hollister includes Hollister and Gilly Hicks. A&F targets men and women in their 20s and onwards, while Hollister targets the teens. The firm reports sales under these two brand segments and three geographic segments – Americas, EMEA, and APAC. But for simplicity, this report will consider US sales and international sales. The author reviewed Form 10-Ks from FY2008 to FY2024, so the charts below only show data starting from FY2008.

Historical Trends

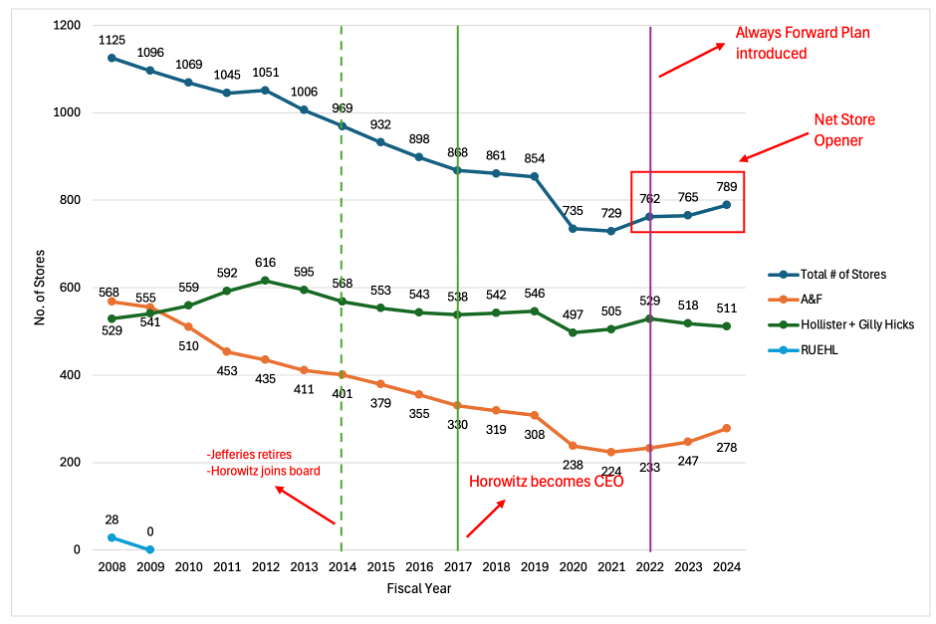

The total store count has continuously declined over time, reflecting a deliberate effort to optimize the global footprint. Hollister has remained relatively stable at ~500 stores, while A&F stores steadily contracted. Starting FY2022, the change in the net store count for A&F turned positive, leading to three consecutive net store openings. From Figure 1, we can see that the demand for Hollister has been steadily strong compared to that for A&F.

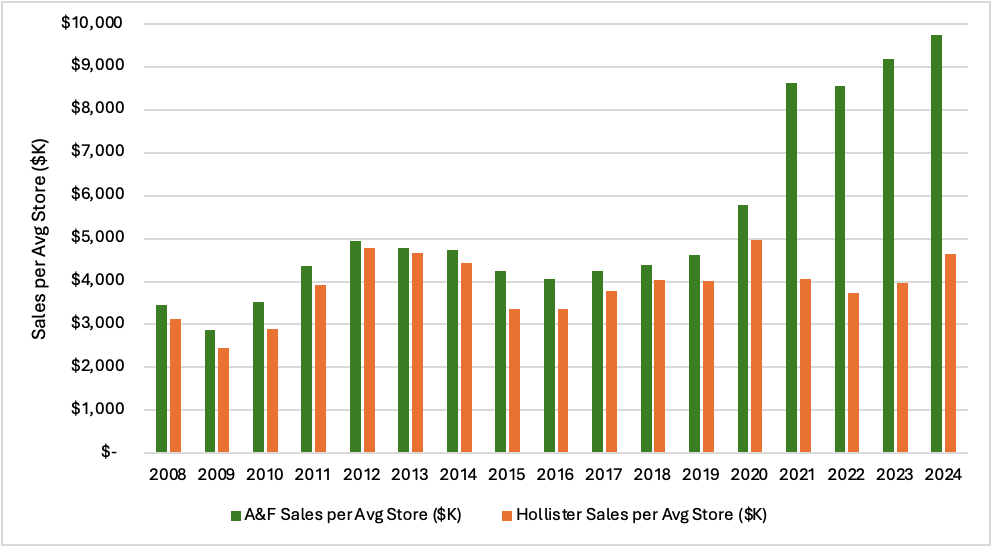

The analysis of the demand for each brand becomes clearer when looking at the total sales and per-store sales by brand.

As Figure 3 shows, it is also notable that the sales throughput of the A&F brand has been explosive since FY2021. Despite a 50% reduction in A&F store count since FY2008, sales per store have more than tripled.

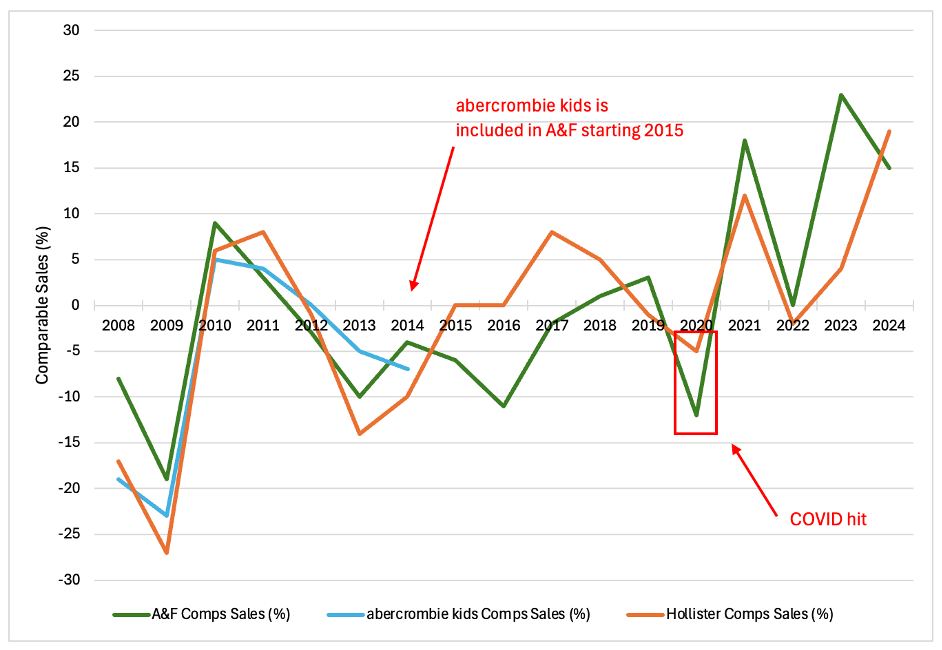

The comparable sales (comps) figure is another metric that reflects the health of the brand and the business operation overall. During former CEO Jefferies’s time, comps were volatile and directionless. After the new CEO, Fran Horowitz, took over, the slope of the comps trend turned decisively positive. See Figure 4.

It is evident from Figure 1 and Figure 3 that management has been putting a lot of effort into rebuilding the A&F brand—from one that focused on “exclusivity” during the former CEO’s leadership to one that resonates more broadly today. The evolution of the business through this leadership change will be discussed in more detail in the next section.

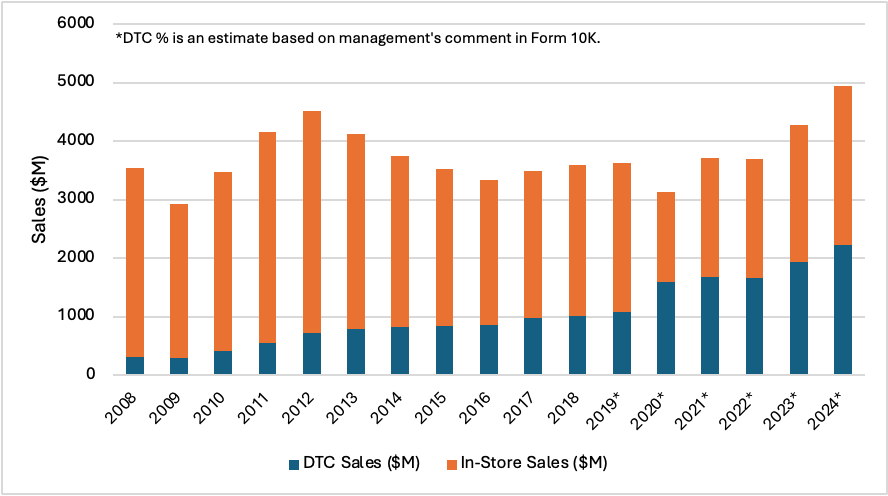

Online—or digital—penetration has also been increasing. It was repeatedly noted in the Form 10-Ks that digital traffic has shown steady growth. The management’s effort to grow online sales is reflected in the addition of Samir Desai to the executive team as Chief Digital and Technology Officer. Under Horowitz’s leadership, the sales strategy has shifted toward a true “omnichannel” retail approach—one that encompasses multiple ways of buying and picking up the product, rather than relying solely on in-store or direct-to-consumer (DTC) channels.

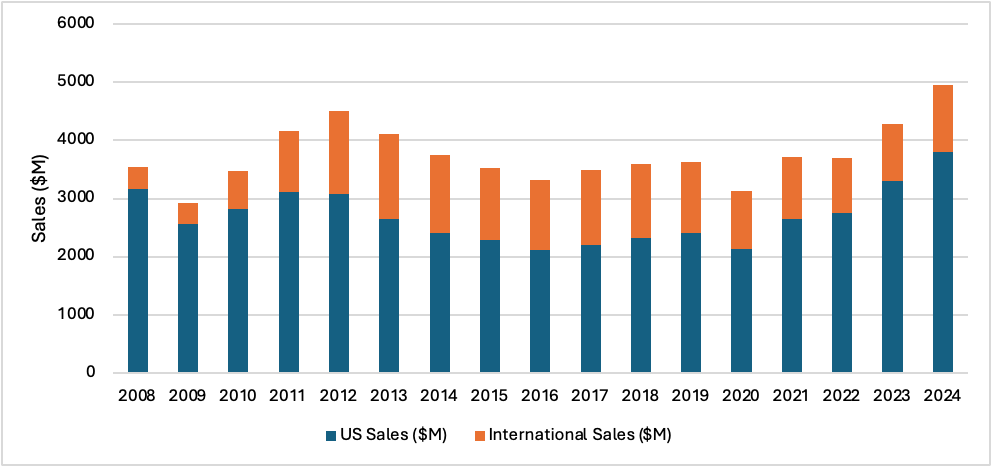

International sales (i.e., all sales outside the U.S.) have been repeatedly cited in Form 10-Ks as a major growth driver. However, there has not been a meaningful increase in the proportion of international sales compared to total sales each year. More notably, U.S. sales have significantly increased. From this, I conclude that the product mix each brand has showcased has been more appealing to U.S. consumers than to international ones. That said, international growth remains a critical opportunity for the business and continues to be a “homework” item for management. An effort on this front can be seen in the recent elimination of the Global Brands President role in early 2024—previously held by Kristin Scott—and the reassignment of brand leadership to regional managers reporting directly to Horowitz. I believe that such decentralization will help drive sales both in the U.S. and abroad.

Unit Economics

The unit economics of this business is focused on the profitability of each store. Sales figures are provided for each brand, but expenses are shown on a consolidated basis. Hence, this unit economics analysis is conducted at the company level—aggregating both brands.

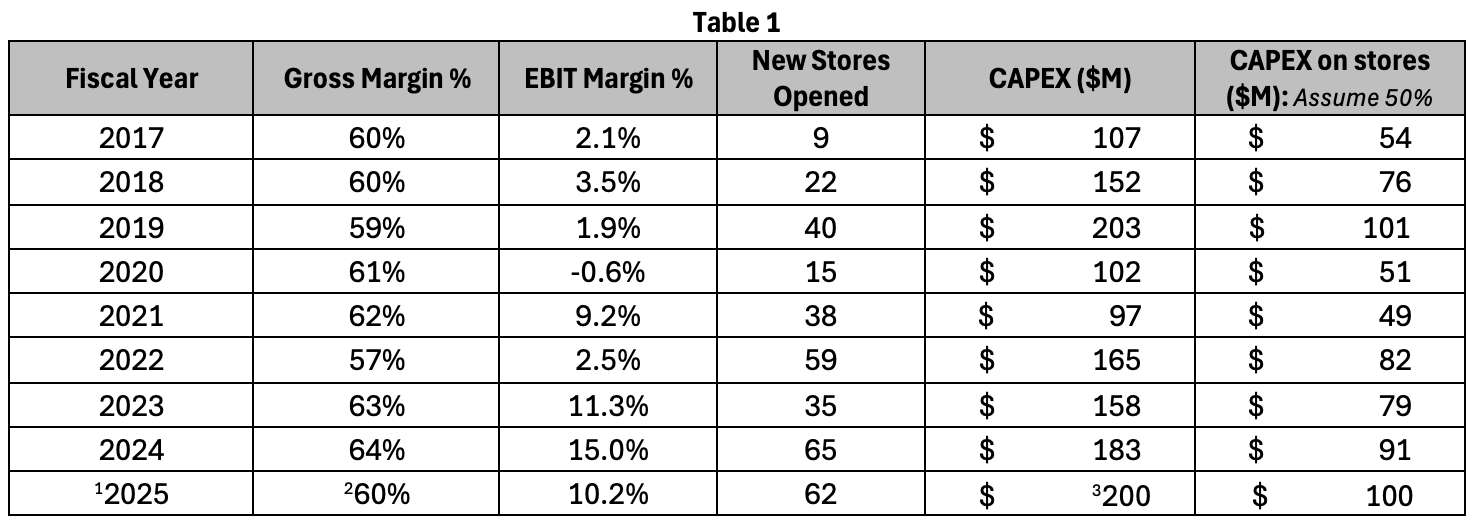

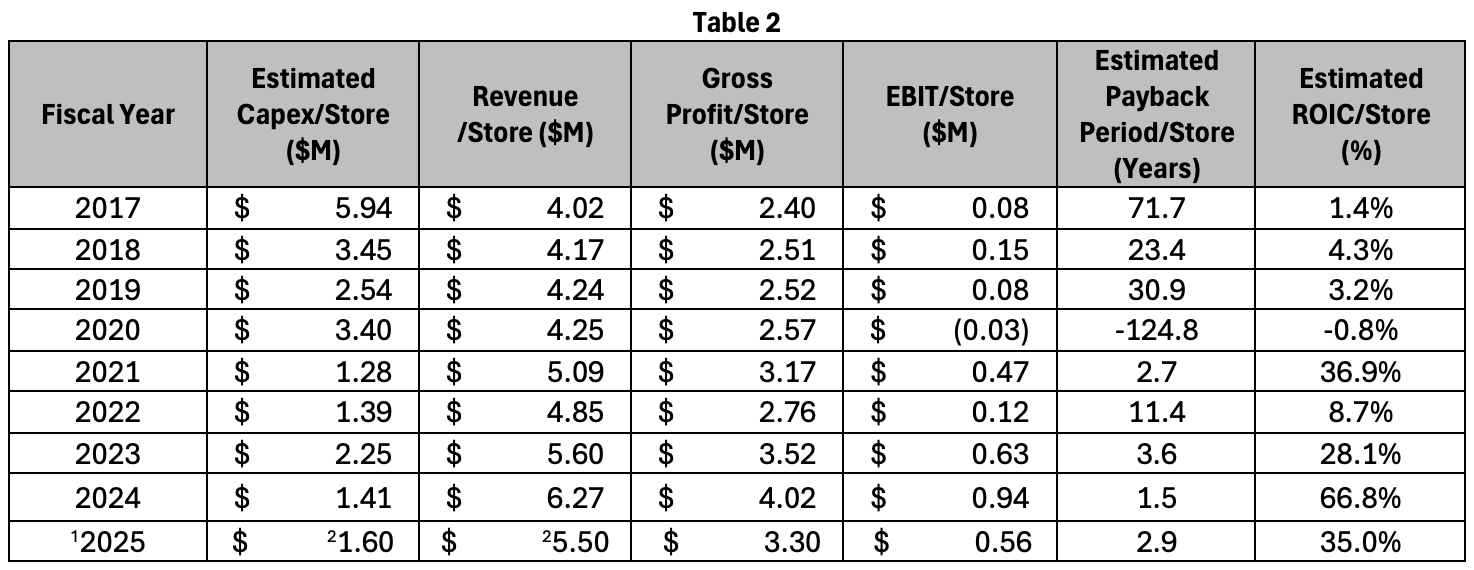

After Horowitz took over in 2017, per-store profitability began to improve. In the first few years, the company restructured its store footprint, shifting away from large, extravagant flagship locations toward smaller-format stores. This transition led to fluctuating per-store profitability in the short term. In recent years, however, profitability has rebounded at a fast pace.

Starting in fiscal year 2021, per-store profitability began to trend upward. FY2022 was a down year, driven by significant supply chain disruptions (notably higher freight costs) and inflationary pressures on raw materials and labor. This highlights how macroeconomic pressures—particularly inflation and suboptimal sourcing logistics—can meaningfully impact store-level profitability.

FY2022 was also the year management introduced its new long-term strategy: the “2025 Always Forward Plan,” which focuses on brand growth, digital penetration, and financial discipline. From the challenges in FY2022, I believe management learned how to build greater resilience to macroeconomic shocks. Looking at FY2023 and FY2024 per-store profitability, it appears the new strategy is starting to bear fruit. That said, it would be too optimistic to assume FY2025 and FY2026 profitability will remain at FY2024 levels.

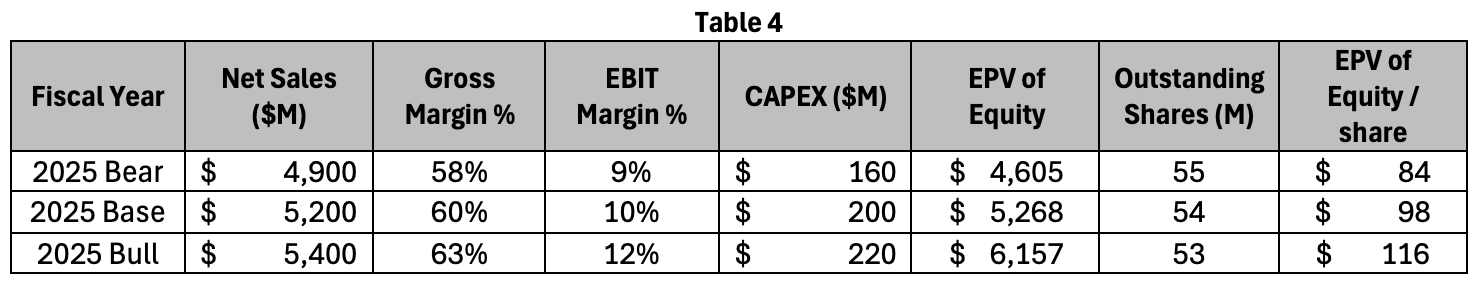

On a conservative basis, the author believes new stores will yield approximately 35% ROIC per store, with an estimated 3-year payback period. Based on management’s FY2025 CAPEX guidance of $200M—and assuming $1.6M in CAPEX per new store—I estimate ~62 new store openings for FY2025. These stores would generate approximately $344M in incremental sales, assuming $5.5M per-store sales. That implies total company revenue of ~$5.3B for FY2025.

With a 60% gross margin, gross profit would be approximately $3.2B. Applying a 35% ROIC per store implies an operating margin of 10.2%, which would result in ~$540M of operating income.

Risks

The everchanging fashion trend is the single biggest risk factor for this business. The Scuttlebutt Method—mainly reading Reddit posts and watching YouTube and TikTok clips and comments—is useful to gauge the likeability of the current product mix. If consumers don’t like the product, they won’t buy it.

Weekly releases are important, as that’s how the business captures consumers to stack up their carts for the seasonal “hauls.” Active potential buyers and previous A&F customers—especially female consumers—regularly share opinions on Reddit about the weekly drops. It’s a red flag when customers say the quality feels like SHEIN, GAP, American Eagle, or Forever 21, because they expect Abercrombie to be a step above in both quality and style.

Recent Reddit posts (2024–2025) suggest that many current releases lack quality—being described as boring or too trendy. However, the numbers say otherwise. It’s also important to keep in mind that dissatisfied consumers are more likely to voice their opinions strongly and frequently on social media.

There is also mixed sentiment around the direction management is taking. Some say they miss the old 2000s-era Abercrombie, with its controversial slogans and “dark, sexy” vibe under Jefferies. But most of those people are millennials now in their 40s (those who were in college in the early 2000s, and my guess is that they were the ones who wore A&F to look cool). Others say they like the new Abercrombie and the various sizes that are offered. As an investor, I put more weight on the latter group, especially since the numbers also validate the direction taken under Horowitz versus Jefferies.

And frankly, who would buy from a company led by a pedophile? No one.

Mark Cohen of The Robin Report writes, “A particularly challenging dilemma facing a retail CEO’s management of assortment strategy and execution is discerning the difference between catering to a broad group of customers’ needs and wants and pandering to a lesser number of them.” This dilemma could not be more relevant for Horowitz. Fortunately, she has embraced the ongoing evolution of consumer preferences—both in product mix and sales channels.

As an investor, it’s difficult to measure exactly how the operating model adapts so quickly to change, but the results can be qualitatively inferred from the culture and financial output.

The risk of CEO Fran Horowitz damaging the company’s reputation or internal culture appears low – especially it is very clear that Horowitz is taking the exact opposite path from the one taken by Jefferies. Based on my research, there were a plethora of former-employee accounts describing how toxic the environment was under Jefferies. Managers allegedly took photos of shirtless male associates (“models”) and held so-called “parties,” which were rumored to be employee sex parties. (A Netflix documentary, White Hot: The Rise & Fall of Abercrombie & Fitch, reveals that Jefferies and the main photographer Bruce Weber, who was instrumental in shaping the brand’s marketing, have been accused of exploiting young male models under the guise of recruitment and brand promotion.) That toxic environment is now gone.

Under Horowitz, human capital management is prioritized, with a focus on associate engagement and incentives—both of which are key to attracting and retaining talent.

Management Quality: How is the management?

The quality of management plays a crucial role in this business. The consumer discretionary retail space is highly competitive. Hence, any misstep by leadership can significantly impact the business and its future operations. Historically, the CEO’s leadership has had a tangible effect on how this business performs.

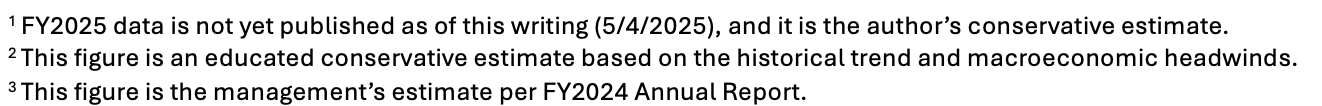

A&F under Jefferies - Exclusion

Former CEO Michael Jefferies led A&F for 22 years – from 1992 to 2014. Under his leadership, the Abercrombie & Fitch brand focused on an exclusive image. Ivy League, privilege, luxury, classic, sexy, charged atmosphere, provocative, and idolized were the words used to describe the A&F brand. Even the abercrombie kids brand had an exclusive feel—a “prestigious East Coast prep school type.” All of these words were pulled directly from annual reports during Jefferies’s leadership. If I were a consumer back then, I wouldn’t have bought anything from A&F.

There were several notable moments while reading through the annual reports where I thought, I really don’t like how management ran this company—or how capital was deployed under Jefferies.

First of all, one of the risk factors disclosed during Jefferies’s era indicated that his compensation expense could “adversely impact” the “cash flows, financial position, or results of operations and could have a dilutive effect” on common stock. On first read, I was stunned by how greedy a CEO could be.

Secondly, there was a deliberate effort to obscure the business reality by focusing on nonsensical non-GAAP figures. The annual reports frequently excluded store-related asset impairments and exit charges from EPS figures. But in truth, those charges were substantial—and recurring. I initially assumed they were one-time items, but every year, large impairment charges were booked. This revealed that store-level operations were unstable, and that there were fundamental flaws in the store strategy.

Thirdly, financial discipline was nonexistent. The company continued to pay dividends despite inconsistent profits. It also repurchased a considerable amount of stock every year—even with borrowed money—despite intrinsic value (owner’s earnings or earning power value) being well below the share price. Every year was a rerun of value-destructive capital allocation. Just to inflate EPS, Jefferies repeatedly destroyed shareholder value. Not to mention that he had a corporate jet that was ultimately sold at a significant loss when he allegedly “retired.” A corporate jet for a <$4B sales company? Ridiculous.

Based on what I read, it felt like he was almost forced out of the company. Well-deserved, indeed.

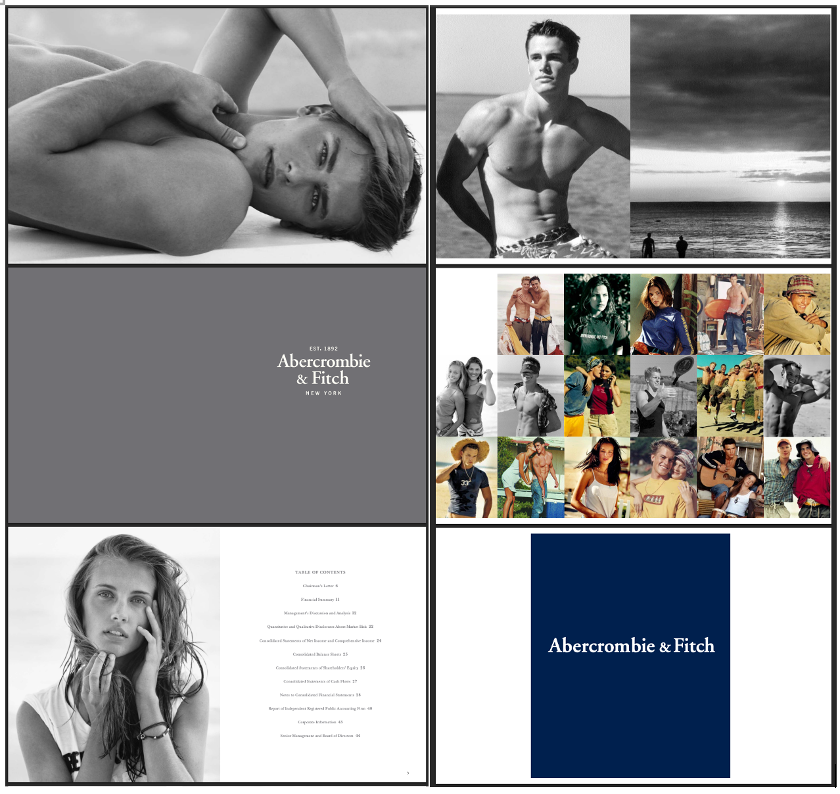

A&F under Horowitz – Brand Separation and Inclusive Image

Jefferies abruptly retired at the end of 2014. Fran Horowitz was brought in as Brand President of Hollister later that year. Two years—2015 and 2016—passed with the CEO seat vacant.

In 2017, Horowitz was appointed CEO and immediately began a full overhaul of the business. She put a hard stop to the discriminatory, high sex-appeal-driven brand image. The entire operating philosophy changed. In interviews between 2021 and 2024, she stated that under Jefferies, the company “told the customer what it wanted”—but under her leadership, the company now “listens to customers to understand what they want.”

The transformation didn’t stop there. Horowitz recognized that A&F and Hollister were essentially competing with each other—targeting the same demographic and cannibalizing sales. A decision had to be made: combine the brands or separate them. She chose to separate them. A&F would target young millennials; Hollister would target teens.

The New Abercrombie & Fitch

The new Abercrombie & Fitch is no longer the brand teens wore in the 2000s to look like the skinny “cool kids.” Horowitz reimagined A&F as clothing for young millennials to wear over a 4-day (96-hour) weekend: a wedding, a picnic, a date night, a gym session.

Gone are the big, loud Abercrombie logos. The brand now offers dresses, blouses, jeans, shirts, and tees in a wide range of sizes. For women: petite to tall, including the “Curve Love” line for curvier customers. For men: size options accommodate long/short torsos and long/short legs. This is a meaningful shift toward inclusivity.

Impact of Rebranding

After five consecutive years of negative comps, 2017 marked the first year of positive comparable sales under Horowitz’s leadership. She spearheaded the “Global Store Network Optimization,” in which large, inefficient flagship stores were either closed or converted into right-sized, higher-throughput stores.

Signs of financial discipline started appearing in the annual reports during her tenure. Buybacks were paused when appropriate. The dividend was suspended during COVID. Expenses began to decline, leading to stronger operating leverage. On the sourcing front, China exposure was reduced significantly—from 42% in 2017 to 7% in 2024. Vietnam exposure rose from 24% to 35% over the same period.

When COVID hit in 2020, management acted quickly. They secured a floating-rate loan to prevent a potential liquidity crunch. Later, when rising rates became a risk, they refinanced into 8.75% fixed-rate bonds to eliminate the floating-rate exposure. In 2024—after delivering the best operating performance under Horowitz’s leadership—the company completely paid off those bonds. That’s the kind of capital allocation shareholders want to see.

In addition to financial discipline, Horowitz transformed the company culture by heavily investing in associate development. Under Jefferies, the company faced multiple lawsuits from associates alleging unpaid wages and racial discrimination. These are the frontline employees—the people who directly engage with customers—so it’s clear they play a critical role in the business’s success.

Horowitz launched a “Human Capital Management” initiative to build an inclusive and empowering environment for store associates. In several 2024 interviews, she shared that many associates “aged with the A&F brand”—a nod to high talent retention and the evolution of the brand image. This investment in people continues to be a core focus under Horowitz’s leadership.

The Verdict

So, what’s the verdict on management quality? I like Horowitz. She prioritizes culture—i.e., investing in associate experience—alongside financial discipline, a sensible approach to sourcing, and continued investment in digital operations. There’s no Supplemental Executive Retirement Plan—the golden parachute that Jefferies received. No corporate jet for the execs. Compensation incentives are tied to EBIT growth, not EPS manipulation.

When taken individually, each of the decisions that Horowitz made is rational. But together, they create what Charlie Munger calls a lollapalooza effect – multiple forces acting in the same direction to produce outsized results. As Munger said, “When you get lollapalooza effects, you often get a ferocious result that’s way beyond anything you would have expected from the additive effects of the forces involved.”

I believe these combined efforts helped the company to deliver nearly $5B in sales in 2024. While double-digit growth in 2025/2026 may be optimistic under current macro conditions, continued steady growth under Horowitz seems very reasonable.

Valuation: Is there a margin of safety?

Earning power value

A&F operates in the consumer discretionary industry. This means that when consumers don’t want to spend money, A&F’s sales will be among the first to get hit. The tendency for consumers to spend depends heavily on the macroeconomic backdrop. With the current inflationary pressure from rising tariffs, consumer confidence is declining, and wallets are tightening. I, also as a consumer, am very aware of near-future price increases due to tariff impacts.

Therefore, it is difficult to apply a full growth value to A&F. A significant discount to the earning power value must be applied for a risk-averse investor.

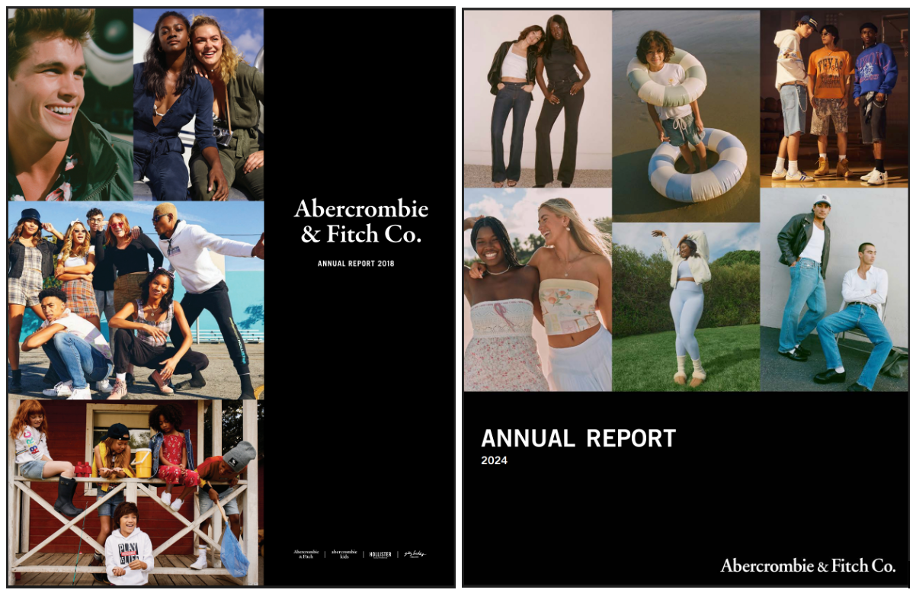

Earning power values of the equity for FY2019 ~ FY2024 were calculated as shown below.

Risk/reward ratio

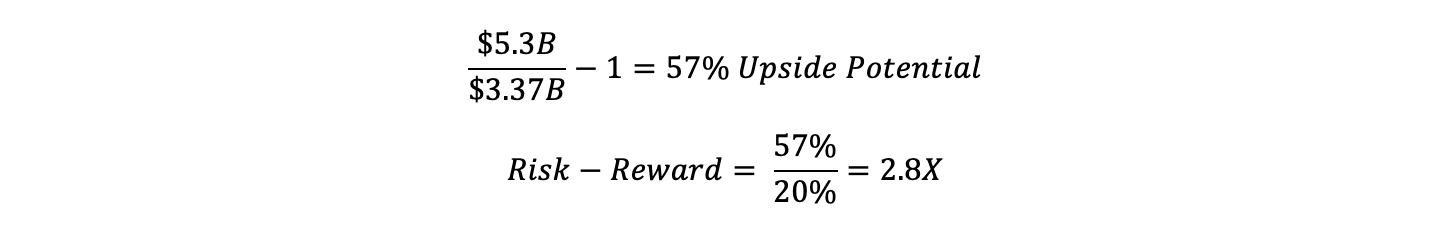

A&F’s current market capitalization is $3.37B (as of 5/2/2025), while the EPV (Earning Power Value) of equity for FY2024 is $6.85B. If we assume a reasonable probability of the stock falling an additional 20% from the current price, and FY2025 EPV of equity is ~$5.3B, then the risk/reward ratio can be calculated as follows:

The calculated risk/reward ratio is 2.8X—an attractive asymmetric investment opportunity.

If we assume a $5.0B EPV and a 30% drop in stock price, the upside potential becomes 48%, and the risk/reward ratio drops to 1.6X—still positive, though below the ideal 2X threshold.

Margin of safety

The current stock price of $70 per share (market cap of $3.37B as of 5/2/2025) implies:

• A 54% discount to the FY2024 EPV of equity per share

• A 30% discount to the FY2025 estimated EPV of equity per share

Breakdown by scenario:

• Bear case: 20% upside

• Base case: 40% upside

• Bull case: 66% upside

Conclusion

A&F went through tough times in the 2000s and mid-to-late 2010s under former CEO Jefferies. Fortunately, a prudent business operator and capital allocator, Fran Horowitz, took over and turned the business around. She redefined the brands, shifted to smaller-format stores, expanded digital channels, and maintained strict financial discipline.

Thanks to these efforts, the A&F brand was revived and now delivers $9M in sales per store with double-digit comparable sales growth.

There’s no doubt that the current trade environment—with high tariffs from China and Vietnam—will impact margins. But only 7% of merchandise was sourced from China in 2024. Margins will take a hit, but a small one.

The business is structurally sound and well-positioned. Its inclusive brand image fits well in today’s social environment, where exclusivity is frowned upon. Although the current macro pressures have caused the stock price to fall more than 50% year-to-date, the business fundamentals remain intact.

Considering that these macroeconomic pressures are temporary—and that the business is in the good hands of Fran Horowitz—the stock has considerable upside. Any forecast is inherently uncertain, especially in consumer discretionary. But the current stock price is significantly below sustainable earning power value.

Therefore, I recommend buying a piece of this business.

Note: The author has a position in ANF.